The times they are a changin’

Bob Dylan famously sang about … “the times they are a changin’”, and indeed they always are. The thing is that when you work in financial services there are a lot of commentators predicting how and when the times are a changing !

One common theme over the last decade or so has been the direction of interest rates. The demise of the longest low interest rate environment we have ever seen has been predicted many times. Interest rates reached such low levels that common wisdom was that they couldn’t get any lower, but they did. The notion of negative interest rates was an odd theoretical concept at one stage; then it became the norm.

The ECB overnight deposit rate has been hovering around 0% for the guts of a decade and spent more of this period in negative territory than positive.

This low interest rate environment is designed to be good for borrowers and bad for savers. At BCP Asset Management we specialise in structuring investments for risk averse investors. There are many ways of reducing investment risk, but none sits better with a risk averse client than a strong institution putting their name to guaranteeing a minimum return.

The norm for structured products in the early part of the 2000’s – was that an institution guaranteed an investor 100% of their capital back plus a return contingent on the performance of an underlying investment.

These structures comprise three elements – a fixed interest bond which is used to secure the capital at the end of the term; a deduction for costs and the purchase of options on the underlying investment to provide the return. The higher the interest on the bond element the more ‘spend’ is available to purchase the options on the underlying investment.

As we entered the second decade of the millennium the interest rate drought started to take a hold of markets. It became increasingly challenging to structure products which promised both a full capital guarantee and a potential return. Something had to give, and in order to free up ‘spend’ to purchase options on the underlying investment, the investor had to take on more investment risk and we saw structured products which guaranteed 95%, 90% or 85% of the initial investment amount.

This left fewer options for those clients who come into their broker with the “just don’t lose any of my money” opening line.

Well since the start of 2022 we’ve seen the much predicted shift in interest rates become real, and to do so in a far more dramatic fashion than many realise. We’ve seen headlines around the European Central Bank’s “surprise” 0.5% increase in rates in July to nudge them out of negative territory.

Although the ECB rates are the headline rates, investment banks must have multiple sources of funding and what’s important in structuring investment products are the inter-bank rates. These are the rates banks lend to each other and which price in where the market thinks interest rates are headed. Further ECB interest rate increases of around 1.5% have been flagged. There may be some debate over the timing of these but the markets have already priced in these increases.

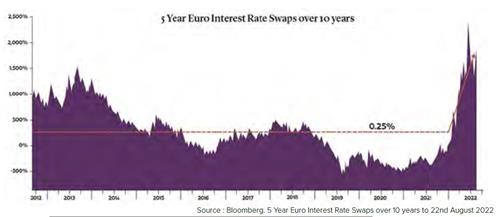

The Euro Interest Rate Swap market is a good indication as to where markets see rates. On the 25th August the ECB overnight deposit rate was 0% but the 5 year Euro Interest Rate Swap rate has just crept over 2%.

Swap rates haven’t been this high in a very long time. In fact for the most part of the last decade 5 year swap rates have been at or below 0.25%. You can see from the graph below just how dramatically rates have turned around since the start of the year.

In addition to swap rates, even the strongest banks are not as strong a counterparty as the ECB, so each bank will fund at a rate in excess of the swap rate to reflect their credit rating (the “spread”).

What all this means in practice is that with such a sharp increase in interest rates, the fixed interest bond component of a structured product is contributing a lot more and enabling much higher levels of capital protection and participation in the growth of underlying investments.

As we exit a protracted period of very low interest rates we also seem to be seeing a return of uncertainty and volatility in equity markets. Growth over the coming years will be hard earned with many bumps hit on the way.

The good news, however, is that the sharp increase in interest rates has slashed the cost of providing capital protection. We are once again able to structure investments which allow more risk averse clients access equity markets with the comfort blanket which comes with full capital protection and that offer attractive upside potential.