Track Record

With 35 years of experience in direct real estate investing BCP has focused on the high street retail and office sectors in core locations where structural sources of growth help unlock rental value.

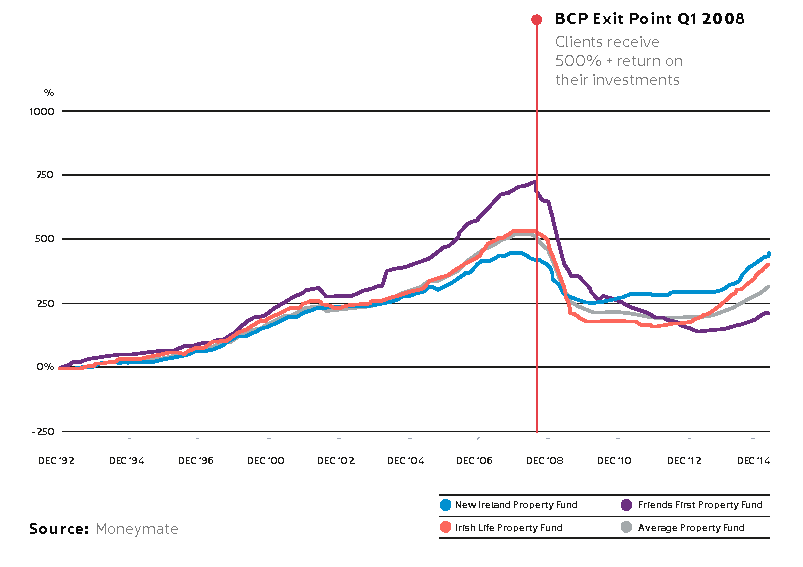

Historically BCP AM achieved property exposure for its client base through investment in tax efficient unit linked funds operated by leading Dublin based life assurance and investment companies such as Irish Life, New Ireland and Friends First.

- BCP has c.€760m of gross real estate Assets Under Management

- BCP has 60,918 sqm (0.655m sq. ft.) of asset experience in 26 properties across Dublin and London

- 102 active tenant relationships

- Vertically integrated real estate expertise

- 100% of all BCP property investments have generated positive investment returns

- Own and operate fully regulated tax efficient real estate funds domiciled in Ireland

In the mid-1990s BCP AM recognised that prime Dublin commercial property was valued at a significant discount to its peers in other European capital cities. This was reflected in low valuations and therefore low unit prices of Irish property unit funds. From 1996 BCP AM advised clients to invest significant sums in these tax efficient funds. In 2007, despite years of strong growth and a buoyant Irish economy, BCP AM took a decision and advised all clients to sell 100% of their Irish property fund holdings.

As a proprietary investor, BCP AM adopted a higher risk strategy. From the mid-1980’s to the late-1990’s, based on the same research that informed recommending the life assurance companies to our clients, BCP AM invested into the Dublin office market forming joint ventures with a number of private clients. BCP AM disposed of the majority of it’s direct holdings accumulated between 1984 and 1998 in 2007 and 2008.

Having decided to switch focus from Dublin to London in 1998 BCP AM engaged in four years of extensive and deep market research. This culminated in the firm pursuing a prime high street retail-led strategy in central London focusing in particular on Bond Street, Oxford Street and the Kings Road. The BCP investment team recognised that London’s West End offered an excellent investment opportunity as valuations were at relatively low levels.

Over the course of BCP AM’s investment in London the firm has moved from core/core-plus asset management strategy to a more active asset manager today, deploying value-add and development strategies into the London and Dublin markets.

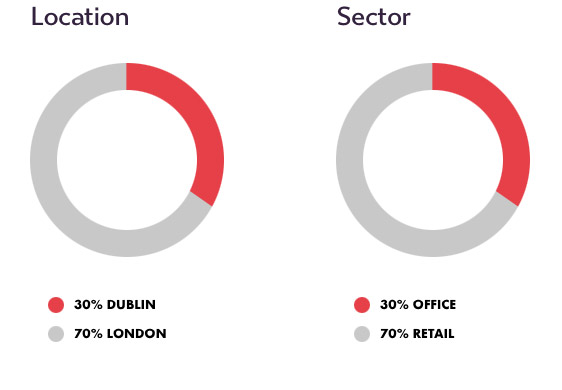

Gross AUM (%)

- LONDON

- Office Established 2001

- Total Personnel 4

- Gross aqusition value €166m

- Gross Aum €534m

- Project Experience 32,654 sq

- Dublin

- Office Established 1993

- Total Personnel 34

- Gross aqusition value €140m

- Gross Aum €240m

- Project Experience 20,553 sq

Performance Report

01.01.92 - 31.12.14

The exit of clients funds from property in 2007 coincided with the sale of the majority of our proprietary portfolio in Dublin.

Warning: Past performance is not a reliable guide to future performance.